fake credit card dispute clothing purchased | credit card disputes fake credit card dispute clothing purchased If you purchased the item through a “buy now, pay later” service that is not offered by your credit card, your rights are different. If you’re having trouble with a credit card, you can . CV-Online ir vieta, kur meklēt un atrast labākās darba un karjeras iespējas visās Baltijas valstīs - Latvijā, Lietuvā un Igaunijā. . Efumo SSC SIA. Rīga, Rīgas rajons, Latvija. Saglabāt. Atjaunināts pirms 1 diena Beidzas: 25.11.2023 € 1500 – 2900. Jaunumi. Blogs; Informācija. Par mums; Kontakti;

0 · legitimate credit card disputes

1 · how to dispute credit card charges

2 · fraudulent credit card dispute

3 · false credit card claim

4 · credit card disputes

5 · credit card dispute settlement

6 · credit card dispute investigation

7 · credit card dispute cases examples

LV Series | FTXS | 9,000 - 24,000 BTU/h (Heat Pump) ¡ 24.5 SEER | 12.5 HSPF ¡ Cooling Range 14 – 115°F (Extended operation to 0 – 115°F with facility setting and optional Air Adjustment Grille) ¡ Heating Range 5 – 65°F ¡ Indoor Sound Pressure as low as 22 dB(A) ¡ Intelligent Eye infrared sensor with the ability

You can dispute credit card charges with your issuer for three reasons under the Fair Credit Billing Act: Someone else used your card without permission. Say a. fraudster. . Use a credit card for online purchases, if possible. Credit cards offer the most protection against fraud compared to other types of payments including the right to dispute .

The Fair Credit Billing Act (FCBA) allows credit card users to dispute charges that involve billing errors and fraud. It also covers services and products not provided as agreed . If your credit card was used fraudulently, you have the right to file a dispute (called a chargeback) with your credit card issuer. Some consumers, however, take advantage of this . If you purchased the item through a “buy now, pay later” service that is not offered by your credit card, your rights are different. If you’re having trouble with a credit card, you can .

What do you do if an unauthorized charge appears on your credit card statement? Or, if you made a purchase, but the seller didn’t live up to their end of the bargain? In either .If you never got your order and the charge appears on your credit card statement, you can dispute it as a billing error. File a dispute online or by phone with your credit card company. To protect .

Credit card disputes may occur when you disagree with the accuracy of a charge that appears on your statement. They typically fall into one of three categories: fraudulent .

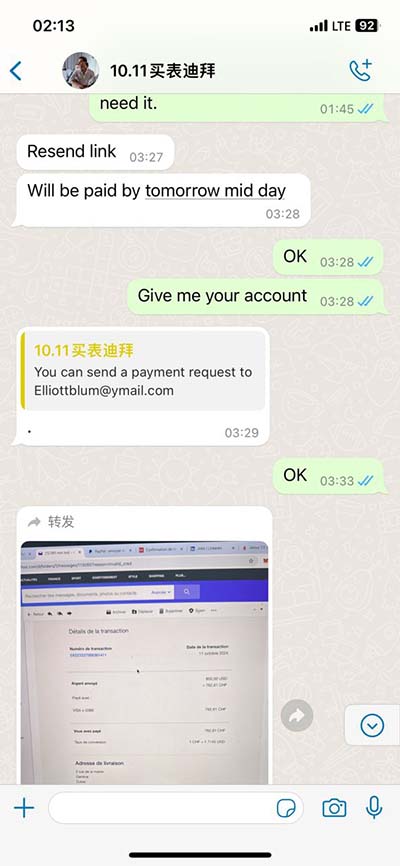

According to the Fair Credit Billing Act, consumers are allowed to dispute a credit card charge within 60 days of it posting to their account. In some cases, even if you willingly paid for something, you can file a dispute. You can dispute credit card charges with your issuer for three reasons under the Fair Credit Billing Act: Someone else used your card without permission. Say a. fraudster. charged a. But what happens when consumers start abusing the system by filing false chargeback claims or credit card disputes? In this article, we break down the dispute process, and discuss the impact of false credit card dispute claims made by cardholders.

Use a credit card for online purchases, if possible. Credit cards offer the most protection against fraud compared to other types of payments including the right to dispute charges if there are problems with your purchase. Always .

The Fair Credit Billing Act (FCBA) allows credit card users to dispute charges that involve billing errors and fraud. It also covers services and products not provided as agreed upon. Understanding the types of problems covered by the FCBA is an important part of correctly using a . If your credit card was used fraudulently, you have the right to file a dispute (called a chargeback) with your credit card issuer. Some consumers, however, take advantage of this safeguard by filing false chargeback claims. If you purchased the item through a “buy now, pay later” service that is not offered by your credit card, your rights are different. If you’re having trouble with a credit card, you can submit a complaint to the CFPB online or by calling (855) 411-CFPB (2372). What do you do if an unauthorized charge appears on your credit card statement? Or, if you made a purchase, but the seller didn’t live up to their end of the bargain? In either case, you’re entitled to dispute the charge and get your money back.

If you never got your order and the charge appears on your credit card statement, you can dispute it as a billing error. File a dispute online or by phone with your credit card company. To protect any rights you may have, also send a letter to the address listed for billing disputes or errors.

Credit card disputes may occur when you disagree with the accuracy of a charge that appears on your statement. They typically fall into one of three categories: fraudulent charges, billing errors, or a complaint about the quality of goods or . According to the Fair Credit Billing Act, consumers are allowed to dispute a credit card charge within 60 days of it posting to their account. In some cases, even if you willingly paid for something, you can file a dispute. You can dispute credit card charges with your issuer for three reasons under the Fair Credit Billing Act: Someone else used your card without permission. Say a. fraudster. charged a.

But what happens when consumers start abusing the system by filing false chargeback claims or credit card disputes? In this article, we break down the dispute process, and discuss the impact of false credit card dispute claims made by cardholders.

Use a credit card for online purchases, if possible. Credit cards offer the most protection against fraud compared to other types of payments including the right to dispute charges if there are problems with your purchase. Always .

The Fair Credit Billing Act (FCBA) allows credit card users to dispute charges that involve billing errors and fraud. It also covers services and products not provided as agreed upon. Understanding the types of problems covered by the FCBA is an important part of correctly using a . If your credit card was used fraudulently, you have the right to file a dispute (called a chargeback) with your credit card issuer. Some consumers, however, take advantage of this safeguard by filing false chargeback claims. If you purchased the item through a “buy now, pay later” service that is not offered by your credit card, your rights are different. If you’re having trouble with a credit card, you can submit a complaint to the CFPB online or by calling (855) 411-CFPB (2372).

What do you do if an unauthorized charge appears on your credit card statement? Or, if you made a purchase, but the seller didn’t live up to their end of the bargain? In either case, you’re entitled to dispute the charge and get your money back.If you never got your order and the charge appears on your credit card statement, you can dispute it as a billing error. File a dispute online or by phone with your credit card company. To protect any rights you may have, also send a letter to the address listed for billing disputes or errors. Credit card disputes may occur when you disagree with the accuracy of a charge that appears on your statement. They typically fall into one of three categories: fraudulent charges, billing errors, or a complaint about the quality of goods or .

legitimate credit card disputes

buy new breitling watches uk

buy breitling galactic

[email protected]. conmed.lv. Closed now. Not yet rated (1 Review) . 1188.lv. Kas izraisa ilgstošu klepu un kā diagnosticēt alerģijas? - 1188 Padomi. Vīrusu sezonā no agra rudens līdz pat vēlam pavasarim esam pieraduši, ka klepo visi - gan bērni, gan pieaugušie. Klepum būtu jāpāriet pašam no sevis, tomēr, ja tas nenotiek 2.

fake credit card dispute clothing purchased|credit card disputes